Financial Wellness

Resources

My Mother's Caregiver: Long-Term Care Insurance

Writer and photographer Mark A. Lee joins us yet again for a guest blog about his struggles advocating for both his mother and himself as a caregiver to long-term care insurance companies.

Read More

How to Handle Advance Directives When a Loved One Has Dementia

Advance directives—legal documents that allow one to express their end-of-life wishes regarding finances and medical care—are important for all of us to consider as we age as a way of retaining decision-making authority no matter what happens to us. However, end-of-life can be a very difficult thing to confront. Even though advance directives are designed to help us protect our wishes and the futures of our loved ones, it's easy to delay making them until a health crisis happens. But what if that health crisis is dementia?

Read More

Weighing the Costs of Living Options as an Older Adult

It’s natural for time to sneak up on you, especially when you reach your retirement years and beyond. As your wants and needs evolve with time, you may want to reevaluate your living arrangements. You may have been planning to move somewhere new for quite a while or, on the flip side, have just begun noticing how big your home feels after your children have moved out. Whatever the case may be, there are plenty of living options you can consider for your next chapter in life.

Read More

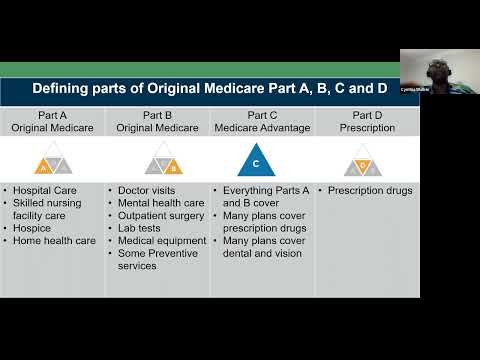

The Basics of Medicare Benefits

Medicare enrollment period is beginning October 15th! Join us for an informative webinar discussing the basics of Medicare and how individuals over 65 can enroll for Medicare benefits. Information includes an overview of Medicare coverage and enrollment conditions with a special focus on considerations for individuals with or at-risk for dementia.

Watch

How to Organize Your Finances as a New Retiree

If you’ve finally reached retirement, congratulations! This is yet another chapter in life you must learn to navigate, as you’ll suddenly have much more time to spend with your personal interests. This could mean you dive deep into a hobby, plan to travel more or find a new part-time job to stay active. Whatever your path may be, you’ll want to make sure you keep your finances organized during your retirement years to remain comfortable and continue pursuing your goals.

Read More